Hence many investors, including us, use some form of a sustainable free cash flow multiple to value a business.

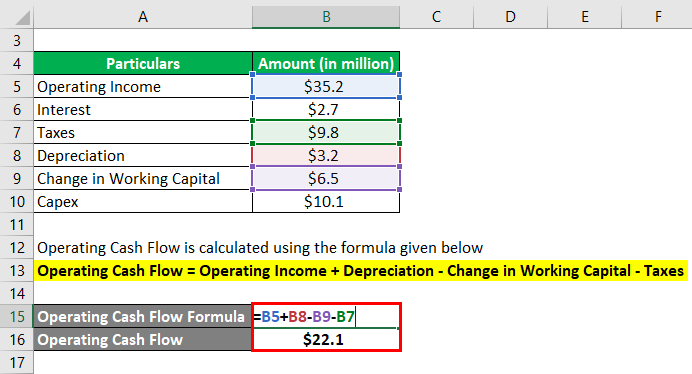

The mechanisms for calculating this are complex, and the selection of the correct discount rate is tricky – tiny changes can have a massive impact on the valuation. Investment theory states that a business is worth the sum of its cash flows in the future, discounted back to today. We then show how we calculate the parameter in a less conventional, but we believe more meaningful way.įirst, a few basics may be helpful. We commend the principle, but in this article we demonstrate thatĪmazon is generating very little free cash flow, relative to its valuation (not unusual for growth companies)Īmazon’s operating cash flow is flattered by its use of stock optionsĪmazon’s presentation of its cash flow is confusing to the lay reader Amazon’s selection of the Cash Flow Statement as its first statement emphasises its importance. Companies can choose which to show first and most choose the balance sheet or the P&L. Amazon is one of very few companies that present cash flow as the first statement in their accounts or 10-K filings.

Amazon is an unusual company in many respects, but one of its key differentiating factors for many analysts and investors is its founder’s emphasis on Free Cash Flow, the most critical metric for many serious investment practitioners.

0 kommentar(er)

0 kommentar(er)